The costs, revenues, and (added) value of the learning/work environment are directly or indirectly reflected in an organisation’s annual accounts (balance sheet and profit and loss account).

Annual account

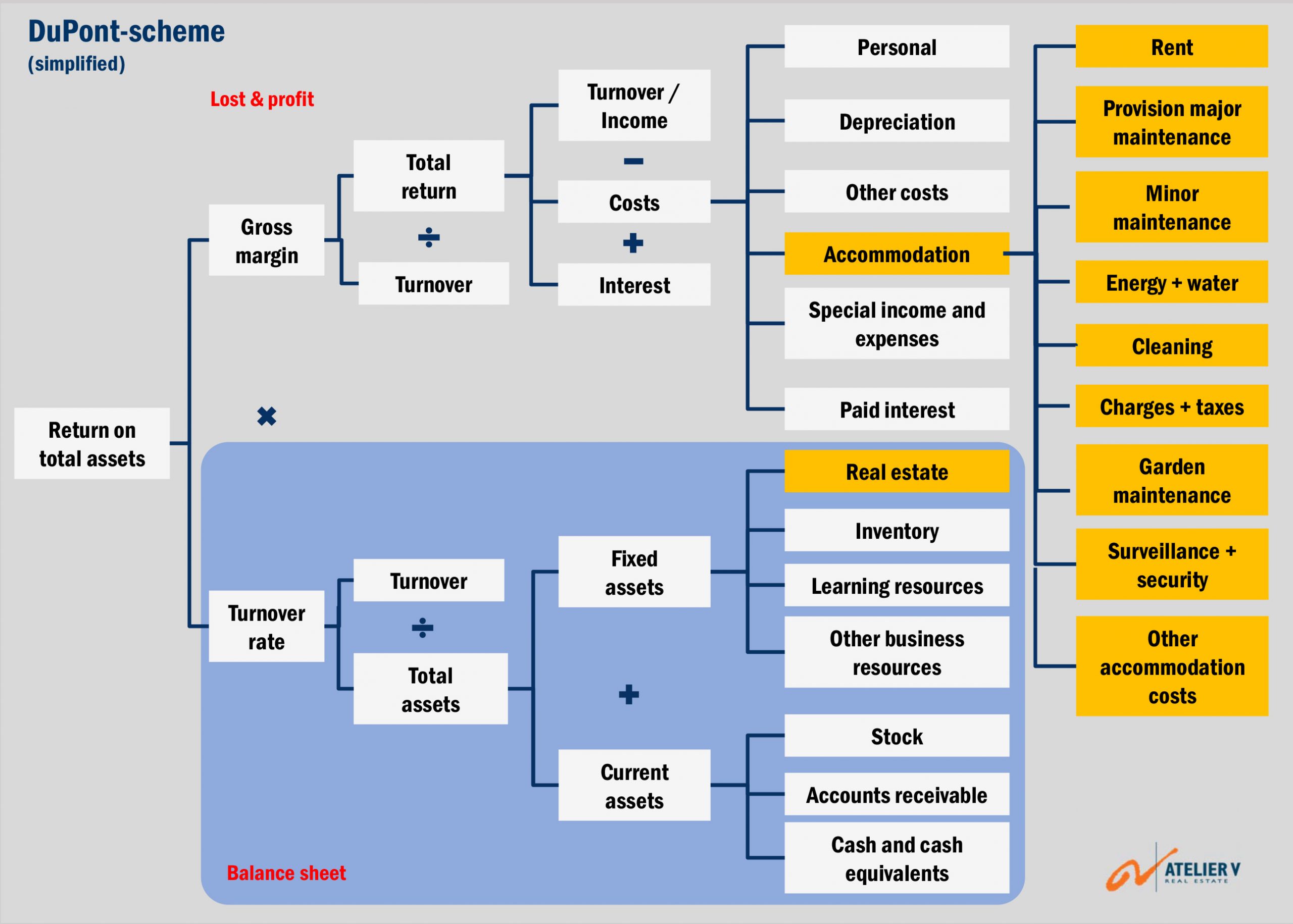

The DuPont analysis can help produce a business-economic analysis of the annual accounts, which can provide insight into and discuss the influence of accommodation on the (economic) return of the assets.

It gains insight into the learning/work environment’s effects on financial management. It provides an integrated business value case to make potential positive and negative leverage effects visible. It answers the question of whether interventions in the learning/work environment are worth it and whether they have a lasting impact on the Return on Investment (ROI).

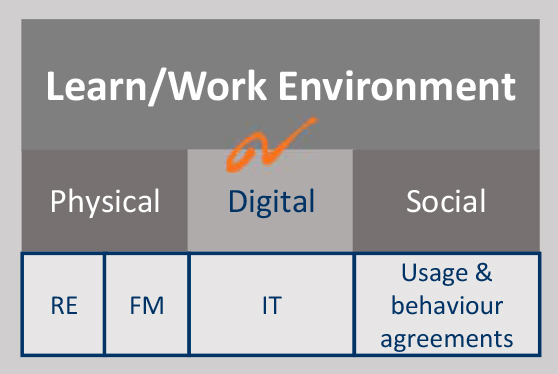

It helps distinguish between “need-to-have” and “nice-to-have” projects. It shows how Physical, Digital and Social components can be used as leverage to improve learning results, working conditions, and cooperation between employees and co-users. The Dupont analysis maps the interaction between maintenance costs and replacement/investment costs and the alignment of Operating Expenses (OpEx) and Capital Expenditures (CapEx).

The learning/work environment is a catalyst for people’s performance and, therefore, has a strategic impact. It is an integrated interdisciplinary approach to unleashing people’s potential. A holistic vision is important here, in which a conductor ensures that the various components of the learning/work environment are coordinated and harmonised to optimally facilitate the most important capital of an organisation: the people.

Distinction between price and worth

Does the price of real estate equal the subjective worth attributed to it, or is the worth of the object the same as the (market) value? In ordinary language, is the worth of real estate similar to whatever you can get for it? Compared to the Dutch language, English distinguishes between price and value using three different words: value, price, and worth.

- Valuating – Process of determining the market price.

- Market price (value) – An estimate of the price the property can fetch on the market at a particular moment in time.

- Price – Actual trade price in the market.

- Valuation -The best estimate of the actual market price by an expert.

- Appraisal – Process of estimating the intrinsic value for an individual or a group of individuals.

- Intrinsic value (worth) – Personal (subjective) estimate of the inherent value by the party/parties concerned.

- Added value (value for money) – The independent simulation of the weighing process of the real estate players in determining their intrinsic value.

The price is the only objective thing that exists: the amount mentioned in the tender brochure or the lease or sale contract. The value of real estate does not exist, for it is an individual and, therefore, a subjective estimate. The worth is the subjective intrinsic value that differs for the owner and for the tenant.

Fitness for use

Comparing two buildings is like comparing apples with oranges: Both are fruits, but the similarities stop there. It is easy to find the differences at first glance, but deciding which building would best suit a specific user or target group is difficult.

The REN methodology helps determine the requirements for existing and new buildings. These requirements vary over time per asset and location (differentiated by layers of change). They are determined by the organisation’s policy goals, value aspects, and portfolio decisions, which change by definition.

Usually, the question of whether the user is satisfied with a building is asked afterwards instead of simulating the consequences of certain accommodation decisions in advance. People evaluating a building often reinvent the wheel. They drown in technical details. An accommodation evaluation is useable only when related to a description of the user’s needs based on their primary process.

Therefore, the consequences for accommodation must be filtered out of the policy or business plan. What kind of work process is taking place inside the building? What are the requirements for the effective and efficient realisation of this process? How can people’s engagement be enhanced? What kind of changes are to be expected in the future? What type of evidence is required as input for feedback and feed-forward steering decisions?

Does the learning/work environment stimulate and support people’s natural curiosity, creativity, motivation and eagerness to learn? Is there a balance between people’s subjective personal preferences, learning/work style, and the objective physical and digital environment dictated by the organisational configuration and management style?

Once the functional accommodation requirements have been determined in this way, they serve as a reference for the accommodation evaluation. Fitness for use is about the needs and requirements of an organisation as a whole and the individual user requirements of employees. It is based on social preconditions such as legislation, standards, environmental, social, and corporate governance (ESC) factors, and economic criteria like time and money.

Preconditions

For a comprehensive appraisal, the owner’s operation costs to maintain the real estate, the user’s facility and IT expenses to enable the actual use should be considered. This approach exceeds a standard valuation of real estate.

The owner or the user acquires improved insight into the financial and operating value of a real estate object for a specific target group or type of use.

Usually, a property valuer focuses on the financial market value and, to a lesser extent, on the operating value. The most common method of valuation is based on a comparison of properties. According to the market, what is or could be the price of a more or less similar object?

Price is not a function of supply and demand only. When the price is based on intuition and checking aspects, and when the intrinsic value is not included in the appraisal, a valuation results in a merely educated guess.

Sensitivity analysis

Each person has a different view of the future. The answer to the question, “How much do we have to pay?” usually depends on third parties’ expectations of the future.

However, the answer to the question, “Should we buy it?” is, by definition, based on one’s estimations of the future. To arrive at the correct policy decisions concerning accommodation and real estate, the decision-maker should become familiar with the sensitivity of specific input data and assumptions of the intrinsic value and the real estate market price. Price and value should be identical in a perfect market where everybody has the same information available.

Having a curriculum vitae listing the significant data on the real estate object at hand creates an opportunity to draw up a sensitivity analysis of the strengths, weaknesses, opportunities, and threats (SWOT) based on scenarios. One can substantiate one’s specific real estate strategy by modulating and simulating different scenarios.

Effect simulation

The DuPont analysis or DuPont Model was developed in 1919 by the American chemical group E.I. du Pont de Nemours and Company. Using the DuPont analysis, it is possible to schematically show the influence that balance sheet and profit/loss items have on profitability. DuPont analysis is a helpful technique for decomposing the different drivers of return on equity (ROE). The decomposition of ROE allows for focusing on the key metrics of financial performance to identify strengths and weaknesses and create information needed to prioritize investments and improve business performance.

Therefore, the DuPont analysis is a simple way, based on an organisation’s actual annual figures, to simulate the positive effect on the (financial) return by increasing revenues, reducing costs, and/or decreasing invested capital. Conversely, the negative effect of a particular measure can also be simulated so that financial consequences do not come as a surprise. It helps to find a balance between effectiveness and efficiency.

Benefits and costs of accommodation

There are two ways a learning/work environment can add value to the organisation: cost reduction and value creation. Accommodation has both benefits and costs. Direct financial income from the accommodation is only available in the event of the sale of real estate, shared use or (sub)letting of space. It goes without saying that sales revenues are only incidental revenues. Like your table silver, you can only monetise it once.

Accommodation’s indirect contributions to an organisation’s value creation process, such as increased employee productivity and student learning performance, cannot be directly deduced from the annual accounts. The same is true of marketing expenditures. People sometimes say half of the marketing budget is wasted money; we only don’t know which half. Nevertheless, significant investments are made in marketing efforts.

Based on the DuPont analysis, possible effects can be simulated using what-if scenarios within the context of the organisation’s strategic goals. In this way, the added value of the accommodation interventions can be quantified in a value case.

Accommodation has both a direct and an indirect effect on an organisation’s cost structure. In the case of ownership, direct costs include interest, repayment, depreciation on previous investments, and the allocation for significant maintenance and operating costs.

Operating costs include matters such as levies and taxes, insurance, energy and water, cleaning, minor maintenance, garden maintenance, and surveillance/security.

In the case of rent, the above costs can be reduced to the rent and the service costs.

There is often a collective item, ‘other accommodation costs, ’ with various incidental and recurring costs attributable to accommodation, such as ICT, relocations, facility costs, and facility personnel.

Value creation

Value creation with the learning/work environment consists of the following:

- Direct income is earned through sales (the positive difference between book value and sales price) and rental income (shared use and/or rental to third parties).

- Direct cost reduction can be achieved by reducing the number of square meters of floor space and/or occupancy costs per square meter.

- Indirect benefits because the learning/work environment positively influences the return from the primary process. Plus, it contributes to achieving the sustainability objectives as part of the social return.

- Indirect reduction in total operating costs (excluding occupancy costs) through a more efficient and effective learning/work environment for the education process.

Organisation goals

By definition, the organisation’s strategic organisational goals are unique. The Strategic Alignment Matrix® helps you map out your own strategic goals and link them to accommodation (Strategic Accommodation Roadmap). Subsequently, interventions in accommodation are derived that contribute to adding value to the organisational goals.

Accommodation influences the four strategic management areas mentioned in the Strategic Alignment Matrix: Finance, Operation, Sales & Marketing, and Human Resources and thus (also) has an indirect effect on the operating costs of an organisation. Accommodation contributes to the economic goals: Finances – Primary process (What can the building do?), And to the social goals, Communication – Personnel & Organisation (What does the building do to you as a person?).

Quick wins

Calculating the quick wins using accommodation scenarios can determine the optimal balance between the four management areas of value creation. The DuPont analysis can be used as a simulation model to explore the financial effects.

A quick scan often yields surprising results, which can sometimes instantly improve the learning/work environment by simply making accommodations more congruent with the business style (management style and culture) or the teaching and learning ideas.

In this way, adaptations to accommodation, however small, can positively help and support development and change in a team. You see the accommodation changes, notice them, feel them, and experience them so concretely that people start moving.

A building is a strategic means to achieve strategic goals. An additional advantage of these adjustments or changes in or to the building is that they communicate well with all stakeholders. And what about other positive effects? How would a pleasant congruent building affect the quality of life and learning/work performance? The absenteeism? Have you ever made that calculation? You will be surprised how this will affect the results. Not only in terms of learning/work performance but also financially.

See also the Real Estate General Performance Survey (RE-GPS) with the Dutch webinar “Inspiring Workplaces that Promote Value Creation” for instructions on applying the Real Estate DuPont Analysis.